by Kirstin Crothers

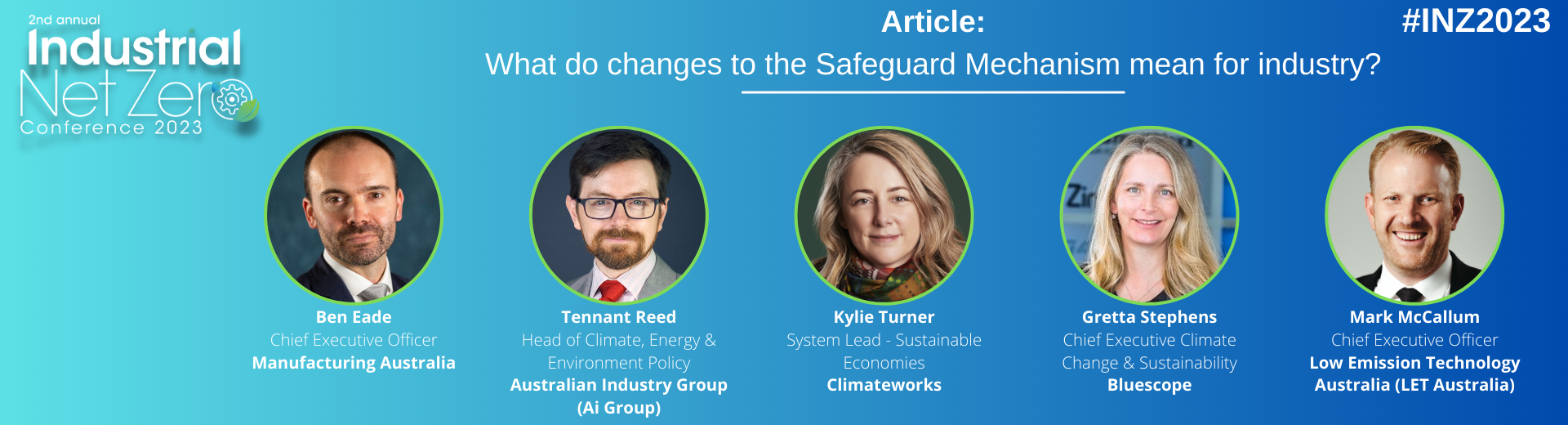

We examine the impact of changes to the Safeguard Mechanism and their effect on the ongoing viability of industry and manufacturing in Australia. This article includes comments from speakers at the Industrial Net Zero conference, including:

- Ben Eade, Chief Executive Officer, Manufacturing Australia

- Tennant Reed, Head of Climate, Energy and Environment Policy, Australian Industry Group (Ai Group)

- Kylie Turner, System Lead - Sustainable Economies, Climateworks

- Gretta Stephens, Chief Executive Climate Change & Sustainability, Bluescope

- Mark McCallum, Chief Executive Officer, Low Emission Technology Australia (LET Australia)

The Australian government has recently proposed reforms to the Safeguard Mechanism. The changes, which rolled out on 1 July 2023, will significantly impact emissions-intensive industries and the nation's overall emissions-reduction efforts. However, concerns have been raised about whether the revamped Safeguard Mechanism will lead to improved emissions reduction or drive manufacturing offshore.

The Australian government has recently proposed reforms to the Safeguard Mechanism. The changes, which rolled out on 1 July 2023, will significantly impact emissions-intensive industries and the nation's overall emissions-reduction efforts. However, concerns have been raised about whether the revamped Safeguard Mechanism will lead to improved emissions reduction or drive manufacturing offshore.

The Safeguard Mechanism was introduced in 2016 as part of the Emissions Reduction Fund (ERF). From then until 2021, emissions covered by the mechanism increased by 4.3%, indicating its ineffectiveness in curbing emissions. With the change of government in 2022, the Safeguard Mechanism reforms became one of the centre planks of the new Labor Government's climate reform agenda. The proposed reforms aim to increase its ambition and guide investment decisions in the industrial sector to drive real and substantial emissions reductions.

Developing the technology to meet the challenge of reducing emissions

Meeting these targets will require complete overhauls in the ways heavy emitters operate. In many cases, there are effectively no proven carbon-free alternatives. The new technologies that have been proposed are expensive and experimental. In July 2022, Bluescope’s Gretta Stephens said while it was a “very exciting time” for new technologies, there also needed to be a “reality check about green steel”.

“It is far more popular in the headlines than in the wild. There is no green steel being produced anywhere in the world”.

Low Emissions Technology Australia (LET-A) Chief Executive Mark McCallum said carbon storage (CCS) was one of the few technologies to be able to decarbonise hard-to-abate industries.

“CCS can be used to remove emissions from steel, cement and fertiliser and other products we use and rely on every day, and it can also be used to produce clean hydrogen — a zero-emission transport fuel that can also help power industry,” he says.

Climateworks’ Kylie Turner hopes that reform of the Safeguard Mechanism can “provide a strong signal to businesses and investors to help the direction of investment and assist with accelerating the commercialisation and deployment of relevant technologies”.

What are the reforms to the Safeguard Mechanism?

- Emissions reduction targets

Emissions baselines for big polluters will be reduced by an average decline rate of 4.9% each year until 2030. This would require Australia's largest greenhouse gas emitters to keep their net emissions below these baselines, forcing facilities to reduce emissions and achieve a total emissions reduction of 100 million metric tons (Mt CO2-e) annually by 2030.

- Carbon offsets and Safeguard Mechanism Credits (SMCs)

The revamped Safeguard Mechanism will introduce a new type of carbon credit, the Safeguard Mechanism Credit (SMC), which will operate alongside the existing ACCUs. Facilities that emit below their limit will be able to earn SMCs, which can be bought by polluters that exceed their baselines to help meet their emission reduction targets. Polluters can use both ACCUs and SMCs to offset their emissions, with no proposed limits on the number of carbon credits that can be used.

- Implications for emissions-intensive, trade-exposed industries

Emissions-intensive, trade-exposed (EITE) industries or sectors vulnerable to competition from overseas producers with fewer environmental regulations will be eligible for grant funding to support on-site decarbonisation activities. Facilities facing significant impacts will also be able to apply for a lower baseline decline rate, potentially as low as 2% for the most affected industries. The Australian government has also indicated that it would consider introducing carbon border adjustment tariffs on imports from countries without a carbon price, similar to the European Union's Carbon Border Adjustment Mechanism.

Industry and stakeholder responses

Business groups, such as the Australian Industry Group (AiG) and the Business Council of Australia, have generally welcomed the proposed reforms, stating that they provide greater certainty for companies and put the country on track to meet emissions targets. However, they also highlight the need for ongoing consultation to refine the final design of the safeguard reforms.

“There has been a bit of a general freak out” by the gas sector and, to a lesser extent, the coal sector, says Tennant Reed of the AiG, as they are likely facing tougher baselines than expected. However, given that the Greens asked for an outright ban on new projects, the net-zero requirement is a compromise.

“It is not unfair to say it could have been a lot worse for the gas sector,” Reed adds.

While gas cannot compete with renewable technologies for power generation, Reed notes that it is valuable for flexible generation and emergency backup, and likely will be for some time. “Getting the last 2% of emissions out of the electricity sector is a big ask,” he adds.

Green groups, including the Australian Conservation Foundation, Climate Council, and Greenpeace, have raised concerns about the proposed reforms, particularly the unlimited use of carbon offsets and the potential for ongoing fossil fuel expansion. They argue that the Safeguard Mechanism should prioritise genuine emissions reduction and place tighter restrictions on new fossil fuel projects.

Impact on manufacturing and export

Ben Eade of Manufacturing Australia gives the federal government considerable credit for the way in which it has listened to manufacturers and responded to their concerns about proposed changes to the Safeguard Mechanism, but says that requiring local manufacturers to reduce emissions by 4.9% each year but not requiring the same of imports would put local plants and jobs at risk.

He is worried that Australia would lose manufacturing capabilities long before we get to realise the opportunities these industries will enjoy as lower-emissions technologies mature. He is also concerned by the carbon border-adjustment mechanism – potentially a narrowly defined scheme for the steel and cement manufacturing sectors.

“If a local manufacturer commits to sustained investment in multi-decade decarbonisation projects, it is reasonable to expect that our policy settings won’t allow them to be undercut by importers that are not required to do the same,” he states.

Eade urges targeted funding for manufacturing and trade-exposed industries, as decarbonisation in hard-to-abate industries is a very expensive undertaking.

Conclusion

The revamped Safeguard Mechanism has the potential to significantly improve Australia's emissions reduction efforts and help the country achieve its climate targets. However, concerns remain. It is essential that the Australian government addresses these to ensure that the Safeguard Mechanism delivers meaningful, genuine emissions reduction while maintaining the competitiveness of the country's industries.

To hear more Ben Eade, Tennant Reed, Kylie Turner, Gretta Stephens, Mark McCallum and others leaders in the large-scale heavy industry at the Industrial Net Zero conference view the agenda or download the brochure.

For more exclusive content written for energy industry professionals sign up to the Energy Insights blog.